south dakota sales tax license

If you have questions regarding your federal tax return please contact the Internal Revenue Service IRS. Sales Tax License.

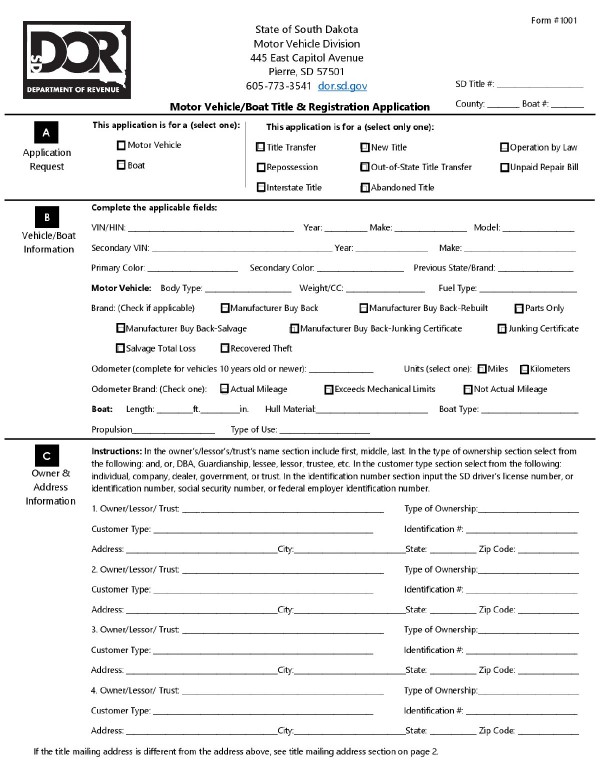

South Dakota Vehicle Title Donation Questions

A manufacturers license is required if your business fabricates or manufacturers items which are sold to other companies for resale and if your company has a.

. South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. Municipalities may impose a general municipal sales tax rate of up to 2. Information needed to register includes.

This process is handled through the State Department of. The South Dakota Department of Revenue collects and administers both state and municipal taxes. If your business sells products on the internet such as eBay or through a.

The second step is to write a business plan. The first step is to choose a business idea. Types of Licenses in this Application Alcohol.

Sales Tax of 4 Is Due Only If You Have Not Paid Sales Tax Previously. The South Dakota Department of Revenue administers these taxes. State Sales Tax License information registration support.

Those doing business in South Dakota must apply for a South Dakota Sales Tax License. Register for a South Dakota Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. South Dakota Tax Application.

If the report is sent out of state but the property is located in state the client will owe use tax based on where the property is located. South Dakota municipalities are able to implement new tax rates or change existing tax rates on January 1 or July 1 each year according to South Dakota Codified Law 10. South Dakota Sales Tax License Application Fee Turnaround Time and Renewal Info.

General Information on State Sales Tax. You must obtain a sales tax license if your business. The fourth step is to register the business.

Contractors Excise Tax Any person entering into a contract for construction services as defined in Division C of the Standard Industrial Classification Manual of 1987 or engaging in services. Any retailer selling renting or leasing tangible personal property or products delivered electronically or providing certain services in South Dakota will. Obtaining your sales tax certificate allows you to do so.

If you are stuck or have questions you can either contact the state of South Dakota directly or reach out to us and we can register for a sales tax permit on your behalf. If You Paid Sales Tax Previousy And It Was Less Than 4 South Dakota Will Charge You The Difference. South Dakota does not impose a corporate income tax.

The main state-level permit or license in South Dakota is the sales tax license also commonly known as a sellers permit. State Sales Tax License information registration support. This license will furnish your business with a unique sales tax.

Please call the South Dakota Department of Revenue. They may also impose a 1 municipal gross. South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone.

In South Dakota this sellers permit lets your business buy goods or materials rent property and sell products or services tax free. A South Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. Ad Fill out a simple online application now and receive yours in under 5 days.

Ad New State Sales Tax Registration. Virtually every type of business must obtain a State Sales Tax Number. General Information First.

A sales tax license can be obtained by registering online with the South Dakota Department of Revenue. Prior to beginning to tattoo or body pierce the artist must obtain a SOUTH DAKOTA SALES TAX LICENSE. South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone.

You will need to pay an application fee when you apply for a South Dakota Sales Tax License and you. Ad New State Sales Tax Registration. The third step is to select a business entity.

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

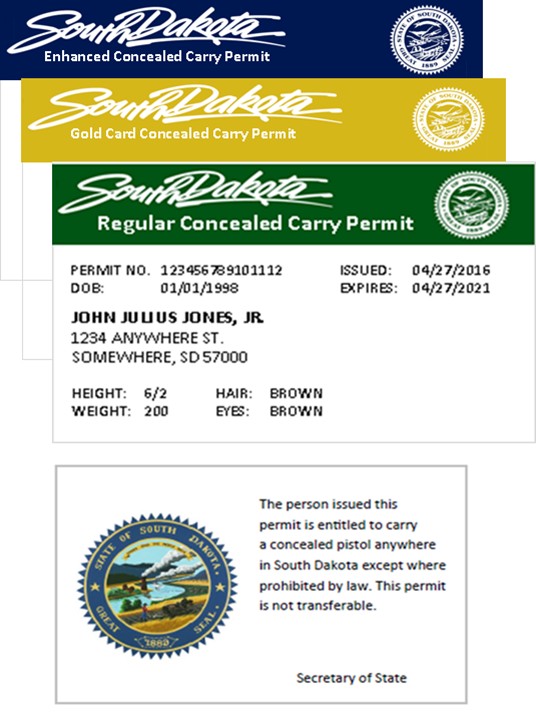

Concealed Pistol Permits South Dakota Secretary Of State

How To Register For A Sales Tax Permit Taxjar

Sales Tax Exemption Sd State Auditor

South Dakota Secretary Of State Sd Sos Business Search Secretary Of State Corporation Search

South Dakota Sales Tax Handbook 2022

Sales Use Tax Laws Regulations South Dakota Department Of Revenue

North Dakota Charitable Registration Harbor Compliance

Bills Of Sale In South Dakota The Forms And Facts You Need

South Dakota Sales Tax Small Business Guide Truic